Core concepts

The Sarcophagus

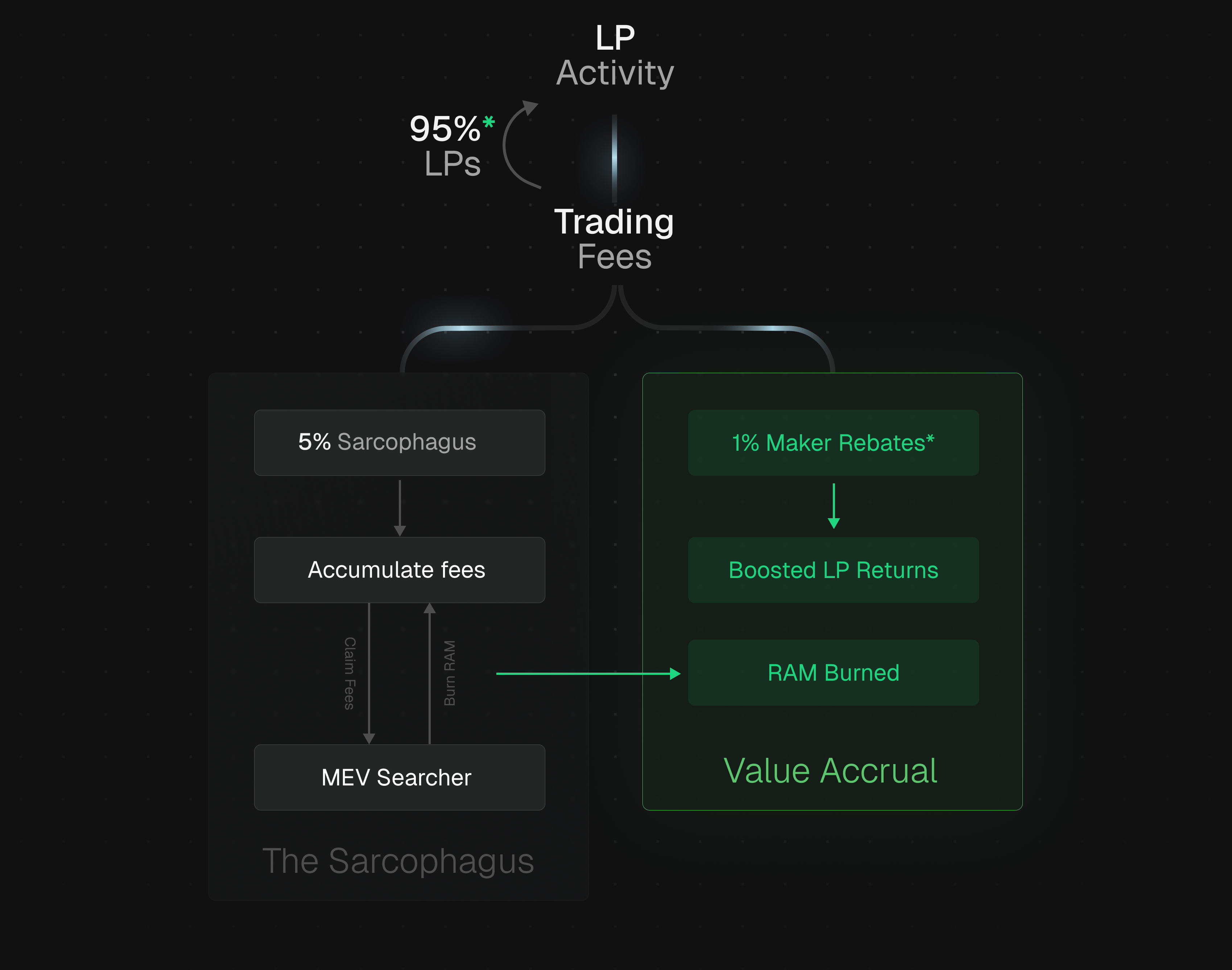

The Sarcophagus: Deflationary Module

A fixed portion of LP fees flows into the Sarcophagus, creating constant and unavoidable deflationary pressure on RAM.

Every pool on Ramses actively burns RAM, on every chain.

How It Works

| Step | Description |

|---|---|

| Fee Collection | 5% of all LP trading fees flow to the Sarcophagus contract |

| Accumulation | Fees accumulate inside the contract until claimed |

| Claim Mechanism | Any user can burn RAM to claim all accumulated fees |

| Finalization | The burn is recorded on-chain permanently |

The mechanics are simple and permissionless.

Fee Distribution

| Allocation | Percentage | Destination |

|---|---|---|

| LP/Makers | 94% | Liquidity providers and market makers |

| Sarcophagus | 5% | Accumulated for RAM burns |

| Maker Rebates | 1% | High-performing LP rewards |

100% of value flows back to users — either as direct rewards or through deflationary burns that increase the value of remaining RAM.

Claim Mechanics

Any user can claim the accumulated fees by burning RAM. This is typically done by MEV searchers who profit from the arbitrage opportunity.

| Action | Result |

|---|---|

| Burn variable amount of RAM | Required to unlock accumulated fees |

| Claim all fees | Receive all tokens accumulated in the Sarcophagus |

| On-chain finalization | Burn is permanent and verifiable |

Anyone can participate in claiming—the mechanism is fully open and trustless.

Deflationary Impact

The Sarcophagus creates constant deflationary pressure that scales with protocol activity:

- More trading volume = more fees

- More fees = larger Sarcophagus balance

- Larger balance = more incentive to burn RAM

- More burns = reduced circulating supply

Liquidity activity becomes deflation by default.

Multichain Burns

The Sarcophagus operates on every chain where Ramses is deployed. This means:

| Chain | Effect |

|---|---|

| Ethereum | Burns canonical RAM directly |

| HyperEVM | Burns RAM, reducing total supply |

| Future Chains | Each deployment contributes to burns |

As Ramses expands to more chains, the aggregate deflationary pressure increases proportionally.

Maker Rebate Program

To bootstrap liquidity and compete directly with other DEXs, Ramses introduces the Maker Rebate Program:

| Feature | Details |

|---|---|

| Allocation | 1% of trading fees |

| Recipients | High-performing liquidity providers |

| Goal | Reward efficient market making |

Market makers who prefer fee yield over emissions can earn higher net returns while still contributing to protocol-level value accrual.

Benefits for Market Makers

- Higher net returns from fee rebates

- No need to participate in governance

- Rewards scale with performance

- Compatible with automated strategies

Combined Value Accrual

The fee structure ensures value flows back to the ecosystem:

| Mechanism | Benefit |

|---|---|

| 94% to LPs | Direct rewards for liquidity provision |

| 5% Sarcophagus | Deflationary pressure benefits all RAM holders |

| 1% Maker Rebates | Incentivizes efficient liquidity |

Whether you're an LP, xRAM holder, or market maker—value accrues by default.